Investment With VVG(Vivid Verse Global)-Substantial investor

$1,000.00 – $25,000.00

Invest with Vivid Verse Global(VVG)

Invest with Vivid Verse Global(VVG)

Exciting Investment Opportunity in Vide Verse Global (VVG)

Vide Verse Global (VVG), a promising startup, was established by the young and dynamic entrepreneur, innovator, and motivational speaker, Nuaym Mohammad Shakil. Despite his tender age of just over 15, Nuaym launched the business in 2020, generating a revenue of $3.5k. The company was officially registered in 2023 across the UK, USA, and India.

Invitation to Potential Shareholders

We are actively seeking early-stage shareholders who can offer financial backing and acquire shares in our company. Our ambition is to expand on a global scale, and we are on track for a Pre-IPO, with an IPO planned for 2030. We cordially invite you to join us on this journey and grow alongside us.

About VVG and NTT Groups

VVG operates as a subsidiary of NTT Groups, a well-established entity with a 30-year history and a presence in 22 countries. The group encompasses 13 companies across various sectors, including VVG, and is currently overseeing a minimum of 17 iconic projects/products.

Valuation and Share Distribution

A corporate valuation expert consultancy has conducted a product valuation analysis, projecting VVG’s worth to be a minimum of $80 million within a 6-7 year timeframe. We are contemplating a total of 80 million shares of the company at a face value of $1 each.

We have resolved to sell 5% of our startup shares, equivalent to 1.6 million shares or $1.6 million with 50% discount and finally selling only $ 0.8 million, to the public. This represents an exciting opportunity for investors to be part of our growth journey.

Investors and partners, we invite you to join us on this remarkable venture as we shape the future of VVG together! 🚀

Call for Participation

We are considering your involvement in our dream projects and business journey as a partner. We are inviting individuals and institutions from around the globe to join us in making this dream a reality.

Investment Details

Investments can range from $1.00 to $25k per account or passport. We are not anticipating large investors or shareholders from global communities. However, if any substantial investor wishes to invest more than the global communities share, please liaise directly with the VVG office. You could potentially reap a 10000% profit (subject to predefined conditions).

For further information, please reach out to the VVG General Office at info@vividverseglobal.com & Visit us -https://info.vividverseglobal.com/

Investment Highlights

Public Offering

We have resolved to sell 5% of our startup shares, equivalent to 1.6 million shares or $1.6 million with 50% discount and finally selling only $ 0.8 million, to the public. This represents an exciting opportunity for investors to be part of our growth journey.

Investors and partners, we invite you to join us on this remarkable venture as we shape the future of VVG together! 🚀

Total Funding Requirement

Our overall funding requirement is $10 million USD until the year 2030. However, we will dilute or sell shares worth $32 million USD, equivalent to 32 million shares out of the total issuance of 80 million shares. This means we are offering $32 million worth of shares for only $10 million, resulting in an impressive 68% discount overall. The gradual distribution of these 32 million shares across the five phases will lead to the company’s ownership diluting to 40% by the end of Phase 5.

Valuation and Share Distribution

Corporate Valuation Analysis

Our expert consultants have conducted a comprehensive product valuation analysis, projecting VividVerse Global (VVG)’s worth to be a minimum of $80 million within a 6-7 year timeframe, aligning with our business vision for the year 2030. This valuation serves as a robust foundation for our investment strategy, appealing to a diverse range of investors.

For detailed financial metrics such as profit, IRR, ROI, NPV, and Payback, please refer to our official website (https://info.vividverseglobal.com/ and https://investments.worldbusinessgroups.com/ ) : VividVerse Global and World Business Groups Investments. These resources provide a deeper understanding of our financial outlook.

Share Structure

We are currently contemplating the issuance of 80 million shares of the company, each with a face value of $1. These shares will be strategically distributed across different funding phases.

Funding Phases and Investment Discounts

Our fundraising approach involves five distinct phases, each offering attractive investment discounts:

- Phase 0 (Startup Funding):

- Share Allocation: 5% of the total allocated shares (equivalent to 1.6 million shares).

- Share Value: Initially at face value ($1), but after a 50% discount, each share is priced at $0.5.

- Investment Discount: 50% off face value.

- Funding Goal: $0.8 million USD.

- Phase 1:

- Share Allocation: 10% of the total allocated shares (equivalent to 3.2 million shares).

- Share Value: Initially at face value ($1), but after a 30% discount, each share is priced at $0.7.

- Investment Discount: 30% off face value.

- Funding Goal: $2.24 million USD.

- Phase 2:

- Share Allocation: 10% of the total allocated shares (equivalent to 3.2 million shares).

- Share Value: Initially at face value ($1), but after a 20% discount, each share is priced at $0.8.

- Investment Discount: 20% off face value.

- Funding Goal: $2.56 million USD.

- Phase 3:

- Share Allocation: 5% of the total allocated shares (equivalent to 1.6 million shares).

- Share Value: Initially at face value ($1), but after a 10% discount, each share is priced at $0.9.

- Investment Discount: 10% off face value.

- Funding Goal: $1.44 million USD.

- Phase 4:

- Share Allocation: 5% of the total allocated shares (equivalent to 1.6 million shares).

- Share Value: Initially at face value ($1), but after a 10% discount, each share is priced at $0.9.

- Investment Discount: 10% off face value.

- Funding Goal: $1.44 million USD.

- Phase 5:

- Share Allocation: 5% of the total allocated shares (equivalent to 1.6 million shares).

- Share Value: Initially at face value ($1), but after a 5% discount, each share is priced at $0.95.

- Investment Discount: 5% off face value.

- Funding Goal: $1.52 million USD.

Description

Investment Highlights

Investment Highlights

Public Offering

We have resolved to sell 5% of our startup shares, equivalent to 1.6 million shares or $1.6 million with 50% discount and finally selling only $ 0.8 million, to the public. This represents an exciting opportunity for investors to be part of our growth journey.

Investors and partners, we invite you to join us on this remarkable venture as we shape the future of VVG together! 🚀

Total Funding Requirement

Our overall funding requirement is $10 million USD until the year 2030. However, we will dilute or sell shares worth $32 million USD, equivalent to 32 million shares out of the total issuance of 80 million shares. This means we are offering $32 million worth of shares for only $10 million, resulting in an impressive 68% discount overall. The gradual distribution of these 32 million shares across the five phases will lead to the company’s ownership diluting to 40% by the end of Phase 5.

Valuation and Share Distribution

Corporate Valuation Analysis

Our expert consultants have conducted a comprehensive product valuation analysis, projecting VividVerse Global (VVG)’s worth to be a minimum of $80 million within a 6-7 year timeframe, aligning with our business vision for the year 2030. This valuation serves as a robust foundation for our investment strategy, appealing to a diverse range of investors.

For detailed financial metrics such as profit, IRR, ROI, NPV, and Payback, please refer to our official website (https://info.vividverseglobal.com/ and https://investments.worldbusinessgroups.com/ ) : VividVerse Global and World Business Groups Investments. These resources provide a deeper understanding of our financial outlook.

Share Structure

We are currently contemplating the issuance of 80 million shares of the company, each with a face value of $1. These shares will be strategically distributed across different funding phases.

Funding Phases and Investment Discounts

Our fundraising approach involves five distinct phases, each offering attractive investment discounts:

- Phase 0 (Startup Funding):

- Share Allocation: 5% of the total allocated shares (equivalent to 1.6 million shares).

- Share Value: Initially at face value ($1), but after a 50% discount, each share is priced at $0.5.

- Investment Discount: 50% off face value.

- Funding Goal: $0.8 million USD.

- Phase 1:

- Share Allocation: 10% of the total allocated shares (equivalent to 3.2 million shares).

- Share Value: Initially at face value ($1), but after a 30% discount, each share is priced at $0.7.

- Investment Discount: 30% off face value.

- Funding Goal: $2.24 million USD.

- Phase 2:

- Share Allocation: 10% of the total allocated shares (equivalent to 3.2 million shares).

- Share Value: Initially at face value ($1), but after a 20% discount, each share is priced at $0.8.

- Investment Discount: 20% off face value.

- Funding Goal: $2.56 million USD.

- Phase 3:

- Share Allocation: 5% of the total allocated shares (equivalent to 1.6 million shares).

- Share Value: Initially at face value ($1), but after a 10% discount, each share is priced at $0.9.

- Investment Discount: 10% off face value.

- Funding Goal: $1.44 million USD.

- Phase 4:

- Share Allocation: 5% of the total allocated shares (equivalent to 1.6 million shares).

- Share Value: Initially at face value ($1), but after a 10% discount, each share is priced at $0.9.

- Investment Discount: 10% off face value.

- Funding Goal: $1.44 million USD.

- Phase 5:

- Share Allocation: 5% of the total allocated shares (equivalent to 1.6 million shares).

- Share Value: Initially at face value ($1), but after a 5% discount, each share is priced at $0.95.

- Investment Discount: 5% off face value.

- Funding Goal: $1.52 million USD.

Almost Zero Risk/Risk Free Investment

ROI/ROR

Return on investment (ROI), also known as the rate of return (ROR), is a measure of how much profit a project generates compared to its cost over a certain period of time. For example, the WBG investment program considers a 2+5 model, which means that the project takes around two years to develop and establish the product, and then five years to generate returns. Therefore, the ROI/ROR period is normally six to seven years. The minimum average expected ROI for this program is at least 4 or 400%, which includes the net present value (NPV) of the future cash flows. This is a safe and excellent investment program that has been witnessed by the world in the IT sector.

IRR

Internal Rate of Return (IRR) is a financial metric that measures the annual rate of growth that an investment is expected to generate. IRR is calculated by finding the discount rate that makes the net present value (NPV) of all cash flows equal to zero. The NPV is the difference between the present value of cash inflows and the present value of cash outflows. The higher the IRR, the more profitable the investment is. The minimum average IRR for a safe investment is above 50%, as witnessed by the world.

PAYBACK

Average payback period is the time it takes for an investment to recover its initial cost. The payback period varies depending on the project, but it is generally between five and six years for a safe and excellent investment. The WBG investment program follows a 2+5 model for most cases, which means that the product development and establishment phase takes about two years, and the payback phase takes about five years.

NPV

Net present value (NPV) is a financial metric that evaluates the profitability of an investment by comparing the present value of its cash inflows and outflows over a certain time horizon. A high positive NPV indicates that the investment is worth more than its cost and can generate a high return. The minimum average NPV for a safe and excellent investment is 20 times the initial investment, but this may vary depending on the specific project.

Shareholder Enjoyment

The shareholders can expect to receive returns after three years, as the minimum and average investment periods for any IT app or e-commerce business are two to three years. After that, the shareholders can monitor the business performance and enjoy the profits with pride.

Exit from business

The minimum and average tenure for any IT app or e-commerce business is more than five years or six to seven years, respectively. This has been proven by the global market trends and data. We also take into account a two-year establishment period for the product development and launch. The shareholders have the option to exit the business or sell their shares anytime after the establishment period (that is, after two to three years).

Investment Glance

Investment

Example: Investing $2.0 in any IT and app related products or projects will yield excellent returns and is considered a very safe investment. We are expecting a minimum return of $20, including the net present value (NPV) of the future cash flows.

Return

The minimum and average returns for any IT and app or e-commerce related business are generally 100% ROI, according to the global market analysis and the world’s experience. However, we are considering a more conservative range of 60-80% ROI, which is still five times higher than any traditional business.

Times of Investment

An investment time horizon, or simply time horizon, is the expected duration of an investment until the initial cost is recovered. The minimum and average time horizons for any IT app or e-commerce business are two to three years, respectively. This has been evidenced by the global market trends and data.

Tenure

The minimum and average tenure for any IT app or e-commerce business is more than five years or six to seven years, respectively. This has been evidenced by the global market trends and data. We also take into account a two-year establishment period for the product development and launch. The complete tenure cycle is therefore seven years, consisting of two years of establishment and five years of operation.

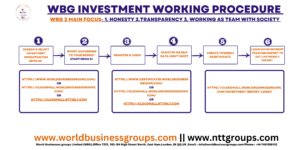

WBG Investment Working Procedure

Introduction

This report aims to explain the working procedure of WBG Investment, a company that offers investment opportunities in various IT and app related products or projects. WBG Investment has three main focuses: honesty, transparency, and working as a team with society. The report will outline the six steps that potential investors need to follow to invest with WBG Investment and access their live weekly reports.

Steps to Invest with WBG Investment

- Search and select investment opportunities: The first step is to browse the available investment opportunities on the WBG Investment website or its affiliated platforms, such as CloudMall. The investment opportunities cover different IT and app related products or projects, such as e-commerce, gaming, education, health, and entertainment. The investors can choose the opportunities that suit their budget and interest.

- Invest according to your budget starting from $1: The second step is to invest in the selected opportunities according to the investor’s budget. The minimum investment amount is $1, which makes WBG Investment accessible and affordable for anyone. The investors can also invest in multiple opportunities to diversify their portfolio and increase their returns.

- Register and login: The third step is to register and login on the WBG Investment website or its affiliated platforms. The registration process is simple and quick, requiring only basic information such as name, email, and phone number. The login process is secure and convenient, allowing the investors to access their account and manage their investments anytime and anywhere.

- Register on self data input sheet: The fourth step is to register on the self data input sheet, which is a document that records the investor’s personal and investment details. The self data input sheet is used to generate the eCertificate, which is a digital document that confirms the investor’s ownership and rights to the investment. The self data input sheet can be accessed and filled online on the WBG Investment website or its affiliated platforms.

- Create yourself eCertificate: The fifth step is to create the eCertificate using the self data input sheet. The eCertificate is a proof of investment that shows the investor’s name, investment amount, investment date, investment period, expected return, and other relevant information. The eCertificate can be downloaded and printed by the investor for their reference and record.

- Login on investment tracking report to get live weekly report: The sixth and final step is to login on the investment tracking report, which is a platform that provides live weekly reports on the performance and progress of the investment. The investment tracking report shows the investor’s current balance, return on investment, net present value, internal rate of return, payback period, and other financial metrics. The investment tracking report also shows the status and updates of the product or project that the investor has invested in, such as the development, launch, and operation phases.

Conclusion

This report has explained the working procedure of WBG Investment, a company that offers investment opportunities in various IT and app related products or projects. The report has outlined the six steps that potential investors need to follow to invest with WBG Investment and access their live weekly reports. WBG Investment is a company that focuses on honesty, transparency, and working as a team with society, and aims to provide safe and excellent returns to its investors.

How WBG Investment Offers High Returns in IT and App Business

Introduction

This report aims to explain how WBG Investment, a company that provides sharing investment plans in various IT and app related products or projects, offers high returns to its investors. The report will compare the potential returns of investing in general business versus IT and app business, and outline the steps and benefits of investing with WBG Investment.

Comparison of General Business and IT and App Business

According to the global market analysis and data, IT and app business generally has a higher return on investment (ROI) than general business. This is because IT and app products or projects have lower costs, higher scalability, and faster growth than traditional products or services.

To illustrate this point, let us consider two scenarios of investing $2.00 in general business and IT and app business, respectively, for a period of 5-6 years.

- In general business, the maximum annual return rate is around 30%, which means that the investor can expect to earn $0.60 per year. The total net profit after 5-6 years would be approximately $7.40, which is 370% of the initial investment.

- In IT and app business, the maximum annual return rate is around 100%, which means that the investor can expect to earn $2.00 per year. The total net profit after 5-6 years would be $32.00, which is 1600% of the initial investment. However, practically, one might expect around $20.00, which is still 1000% of the initial investment.

The above comparison shows that IT and app business can offer much higher returns than general business, making it a more profitable and attractive investment option.

Steps and Benefits of Investing with WBG Investment

WBG Investment is a company that focuses on honesty, transparency, and working as a team with society. It offers sharing investment plans in various IT and app related products or projects, such as e-commerce, gaming, education, health, and entertainment. The investors can choose the opportunities that suit their budget and interest, and enjoy the following benefits:

- Low investment threshold: The minimum investment amount is $1.00, which makes WBG Investment accessible and affordable for anyone.

- High return potential: The investors can expect a minimum return of $20.00, including the net present value (NPV) of the future cash flows, for a $2.00 investment in IT and app business.

- Live weekly report: The investors can access the investment tracking report, which provides live weekly updates on the performance and progress of the investment, such as the current balance, ROI, NPV, internal rate of return (IRR), payback period, and other financial metrics.

- eCertificate: The investors can create and download the eCertificate, which is a digital document that confirms the investor’s ownership and rights to the investment, showing the investor’s name, investment amount, investment date, investment period, expected return, and other relevant information.

To invest with WBG Investment, the investors need to follow six simple steps:

- Search and select investment opportunities on the WBG Investment website or its affiliated platforms, such as CloudMall.

- Invest according to the budget starting from $1.00 in the selected opportunities.

- Register and login on the WBG Investment website or its affiliated platforms.

- Register on the self data input sheet, which is a document that records the investor’s personal and investment details.

- Create the eCertificate using the self data input sheet.

- Login on the investment tracking report to get a live weekly report.

Conclusion

This report has explained how WBG Investment, a company that provides sharing investment plans in various IT and app related products or projects, offers high returns to its investors. The report has compared the potential returns of investing in general business versus IT and app business, and outlined the steps and benefits of investing with WBG Investment. WBG Investment is a company that focuses on honesty, transparency, and working as a team with society, and aims to provide safe and excellent returns to its investors.

Brief details of recourse and available recourse list

[wpdatatable id=1 table_view=regular]

Registration

Additional information

| INVESTMENT PERIOD | LONG TERM, PROJECT BASE |

|---|---|

| INVESTMENT COUNTRY | UK, USA, KSA, INDIA, OTHERS |

| INVESTMENT FREQUENCY | YEARLY, ONE TIME |

-

- Sale!

30GB STORAGE-M

- Original price was: $100.00.$50.00Current price is: $50.00. $50.00

- Add to cart

-

- Sale!

INVESTMENT ADVICE

- $0.00 – $10,000.00

- Select options This product has multiple variants. The options may be chosen on the product page

-

- Sale!

REMOTE IT TRAINING

- Original price was: $2,000.00.$1,000.00Current price is: $1,000.00. $1,000.00

- Add to cart

-

- Sale!

Pliers-(simple-Product)

- Original price was: $40.00.$30.00Current price is: $30.00. $30.00

- Add to cart

Reviews

There are no reviews yet.